Xero App Store Terms and Conditions

Welcome to the Xero App Store! Xero Limited and its affiliates have created these Xero App Store Terms and Conditions (these “Terms”) so that app partners like you can enjoy the benefits of our app store (“Xero App Store”) while protecting both Xero’s and its users’ rights.

You agree to these Terms

By clicking on “I agree” (or a similar box or button), you agree to be bound by these Terms. You may only become an App Partner and use the Xero App Store if you agree to these Terms.

References to you and us in these Terms

In these Terms, when we say “App Partner”, “you” or “your”, we mean you, or, if you are agreeing to these Terms not as an individual but on behalf of an entity, then we mean that entity. When we say “Xero”, “we”, “our” or “us”, we mean the Xero company that you are contracting with, which depends on where you are located (you can find this in the table under section 17 below). Phrases like “we both”, “each of us” or “either of us” refer to both you and us.

Changes to these Terms

We may need to update these Terms as our ecosystem evolves, and will we provide you with notice of any changes as described in section 12 below.

Other terms that apply to you

These Terms are in addition and separate to the Developer Platform Terms and Conditions that apply to your use of the developer platform.

1. How long do these Terms apply?

These Terms will start on the date that you agree to them and will continue until either one of us cancels them as described in section 12 or 13.

2. The Xero App Store

2.1 Getting started

In order to have your application (“Your App”) included in the Xero App Store, you and Your App will need to be certified by us. You can find out more about the requirements that you need to meet here.

2.2 Offering Your App to Users via the Xero App Store

a) Our single sign up feature, currently known as “Sign up with Xero”, allows customers to sign up for Your App using their Xero account. For every customer of yours who has connected their Xero account to Your App using ‘Sign up with Xero’ at any time after Your App was made available in the Xero App Store (each a “User”), you agree to pay us a referral fee plus any applicable administration fee (“Xero App Store Fee”).

b) Xero uses two different methods for billing its App Partners: Xero App Store Subscriptions (see section 3) and Commercial Billing (see section 4). Those sections explain in more detail how Xero will calculate and bill you for the Xero App Store Fee.

3. Xero App Store Subscriptions

3.1 Does Xero App Store Subscriptions apply to you?

Our Xero App Store Subscriptions method will apply to you unless otherwise notified by Xero or if Xero App Store Subscriptions is unavailable in your region.

3.2 How does Xero App Store Subscriptions work?

a) Xero App Store Subscriptions uses the “Stripe Custom Connect” service provided by Stripe Inc. or its affiliates (“Stripe”), as further described on Stripe’s website.

b) Before you can offer Your App on the Xero App Store, you must have, and maintain in good standing, a Stripe Custom Connect account for the purposes of Xero App Store Subscriptions. In order to open a Stripe Custom Connect account and link it to our Xero App Store payment processing, you will need to:

i) complete the Stripe Custom Connect account application process;

ii) receive approval from Stripe; and

iii) agree to the terms and conditions that apply to your use of Stripe Custom Connect, including the Stripe Connected Account Agreement available on Stripe’s website for your region (“Stripe Connected Account Agreement”).

c) We are not responsible for, and have no liability in connection with, the services provided to you by Stripe.

3.3 Processing payments

a) You are solely responsible for determining the price payable by each User for the purchase or use of Your App (“User Payment”) and configuring or initiating those User Payments within the Xero developer portal and Stripe Custom Connect.

b) You must ensure that you are lawfully entitled to be paid any User Payments that you configure or initiate within the Xero developer portal and Stripe Custom Connect.

c) User Payments will be collected on your behalf via Stripe Custom Connect (plus any applicable taxes including GST, VAT or Sales Tax (“Applicable Taxes”) that need to be charged to the User) using the payment methods we make available from time to time.

d) Once a User Payment has been collected, Stripe will deduct on our behalf:

i) the full amount of our Xero App Store Fee for that User Payment; and

ii) any Applicable Taxes that we are required to charge on our Xero App Store Fee.

e) We may also arrange for any other amounts that you are liable to pay us under these Terms to be deducted from User Payments.

f) Subject to any deductions made under sections 3.3(d) and 3.3(e) and any withholding under section 3.11(d), the remainder of each User Payment will be remitted to your Stripe Custom Connect account within 7 days after that User Payment was collected.

3.4 How is the Xero App Store Fee calculated for Xero App Store Subscriptions?

The Xero App Store Fee for Xero App Store Subscriptions will be equal to 15% (plus an administration fee of 2.9%) of User Payments, and will be calculated without reduction for any Applicable Taxes or other government levies.

3.5 Currency

a) You must set your pricing in the local currency for each region of the Xero App Store in which Your App appears.

b) The amounts collected and remitted to you under section 3.3 will be processed in that local currency. If you would like us to arrange for payments to you under section 3.3(f) to be made in a different currency, and we and Stripe support payment in that different currency, we may agree to do so but currency conversion and other fees and charges may apply and be charged by Stripe.

3.6 Taxes and invoices

a) To enable us to calculate any Applicable Taxes, you must deliver to us (in the format and way we request):

i) the name of the legal entity or entities that will deliver Your App to Users;

ii) confirmation of the country of residence and country of establishment for each legal entity that will deliver Your App to Users;

iii) for each legal entity that will deliver Your App to Users, confirmation as to whether the entity is registered for GST, VAT or Sales Tax, and the jurisdiction(s) of registrations;

iv) confirmation of all relevant GST, VAT or Sales Tax registration number(s); and

v) any other information that we reasonably need to calculate the Applicable Taxes.

b) You must notify us immediately if any of the information delivered to us under section 3.6(a) changes.

c) You will not issue invoices to Users for User Payments that we process for Your App.

d) If a User Payment is refunded to the User, we will issue a credit note to the User.

e) The Appendix to these Terms sets out the tax arrangements that apply to the delivery of Your App to Users. You must comply with all of your obligations under the Appendix.

3.7 Failed payments

a) We are only required to arrange for payments to be made to you under section 3.3(f) where a User Payment is actually received. If this does not occur, for example because of a failed transaction, we will take reasonable steps to re-process the transaction (for example, if the transaction failed due to expired credit card details, we would contact the User and ask them to update those details).

b) We will not, however, initiate overdue payment or debt recovery procedures directly against any User, and this will be your responsibility.

c) If a User Payment is not collected, then no Xero App Store Fee will be payable by you in connection with the User Payment, unless either of us subsequently recover the User Payment (and if you recover it directly from the User, including as a result of debt recovery procedures, you must promptly notify us and pay us the associated Xero App Store Fee).

3.8 You give us authority relating to orders for Your App and User Payments

You authorise us to:

a) obtain and process orders for Your App from Users via the Xero App Store;

b) issue invoices for User Payments in respect of the orders that we process;

c) collect the amount of each User Payment;

d) deduct from User Payments any Applicable Taxes that need to be charged to the User, or that we are required to charge on our Xero App Store Fee, and to arrange for those amounts to be remitted to the relevant government authorities;

e) deduct any Xero App Store Fee you owe us from User Payments as set out under section 3.3(d);

f) receive on your behalf any notices or forms prepared by Stripe as part of your use of Stripe Custom Connect, which we will make available to you as required; and

g) use Stripe Custom Connect to conduct any or all aspects of the activities set out above.

3.9 You give us authority to share data with Stripe

You authorise us to:

a) access and use any data within your Stripe Custom Connect account (including any data about your usage of Stripe Custom Connect and the Xero App Store, and any actions submitted by you, or on your behalf, and any transactions) (Stripe Custom Connect Data) for the purposes of exercising our rights and performing our obligations under these Terms, and to enable you and your Users to use, and allow us to improve, develop and protect, the Xero App Store; and

b) share any Stripe Custom Connect Data with Stripe.

3.10 Your important responsibilities for your Stripe Custom Connect account

You agree to:

a) take responsibility for all actions configured or submitted by you, or on your behalf, in relation to your Stripe Custom Connect account (including all transactions, disputes (including chargebacks), refunds, reversals, and associated fines, and any use of the Stripe Custom Connect services that is not allowed under Stripe’s applicable terms and conditions); and

b) not use your Stripe Custom Connect account for any activity listed on Stripe’s “Restricted Businesses List” (located at https://stripe.com/[CountryCode]/restricted-businesses, where “[Country Code]” is the two-letter code for the jurisdiction in which your Stripe Custom Connect account is located); and

c) comply with your obligations to Stripe, and indemnify Xero for any loss, liability, damage, cost or expense, claim or proceeding arising in connection with your breach of any term or condition that applies to your use of Stripe Custom Connect.

3.11 User Payment disputes, refunds and reversals

a) You agree to promptly respond to any queries or disputes from your Users in relation to User Payments. You are responsible for any decision to provide a refund to any of the Users of Your App.

b) You acknowledge that User Payments may be subject to a reversal, including in accordance with the Stripe Connected Account Agreement and rules established by the providers of the payment schemes we use to accept payment (such as chargeback arrangements under credit card schemes).

c) If any User Payment is reversed or refunded, we will keep the Xero App Store Fee for that User Payment unless you can demonstrate to our reasonable satisfaction that the reason for the reversal or refund was beyond your reasonable control and that you did not voluntarily offer it.

d) If we reasonably believe that a dispute from any of your Users in relation to a User Payment is likely to occur, we may withhold an amount equal to that User Payment from any amounts that we owe to you under these Terms until the dispute has been resolved.

3.12 Suspension

We may suspend or limit your use of the Xero App Store if:

a) you fail to maintain your Stripe Custom Connect account in good standing; or

b) we reasonably believe that you have received excessive disputes from your Users in relation to User Payments.

We may take these actions immediately, but we will endeavour to notify you promptly if we do so.

4. Commercial Billing

4.1 Does Commercial Billing apply to you?

Our Commercial Billing method will apply to you as notified to you by Xero, or if Xero App Store Subscriptions is unavailable in your region.

Once Xero App Store Subscriptions is available in your region, we’ll notify you whether you are to remain on the Commercial Billing method or that you are moving on to the Xero App Store Subscriptions method (in which case Xero App Store Subscriptions under section 3 will apply to you from the date specified in that notice).

4.2 How Commercial Billing works

a) After the end of each calendar month, we’ll calculate the Xero App Store Fee for the month that has just ended (as set out under section 4.4) and send you an invoice for that amount, plus any Applicable Taxes. This will apply to the first and last calendar months that Your App is made available in the Xero App Store too (even if that starts or ends part way through the month).

b) You agree to pay us for each invoice within 30 days of the date you receive it from us, via the payment method that you provide to us in the Xero developer portal.

c) If we owe any amount to you, you still need to pay the full amount of the invoice and not set that off against the amount we owe you.

d) If we are required to refund you (either in whole or part) for the Xero App Store Fee, we will issue that refund to you as a credit against your next monthly invoice.

4.3 Taxes

To enable us to calculate any Applicable Taxes, you must deliver to us (in the format and way we request):

a) the name of the legal entity or entities that will deliver Your App to Users;

b) confirmation of the country of residence and country of establishment for each legal entity that will deliver Your App to Users;

c) for each legal entity that will deliver Your App to Users, confirmation as to whether the entity is registered for GST, VAT or Sales Tax, and the jurisdiction(s) of registrations;

d) confirmation of all relevant GST, VAT or Sales Tax registration number(s); and

e) any other information that we reasonably need to calculate the Applicable Taxes.

You must notify us immediately if any of the information delivered to us under this section 4.3 changes.

4.4 How is the Xero App Store Fee calculated for Commercial Billing?

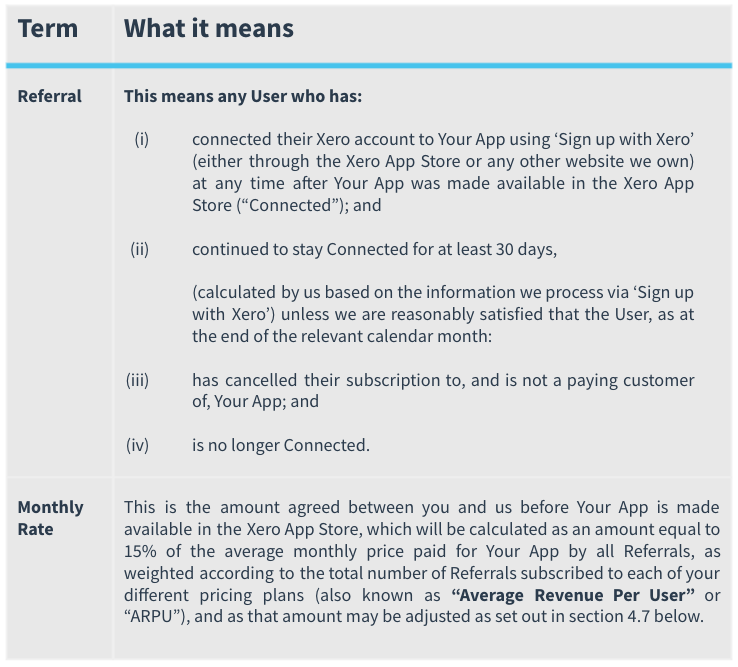

We’ll calculate the monthly Xero App Store Fee for Commercial Billing by multiplying the total number of “Referrals” in the relevant calendar month by the “Monthly Rate”. The table below describes what we mean by these terms:

4.5 If you dispute a Referral

You will be able to view Referrals through Xero's developer portal. If you don’t agree that a Xero App Store Fee should be paid for any Referral, you can dispute it by emailing the details of your dispute to api@xero.com any time up until the first day of the next calendar month. Xero will have discretion to determine the outcome of any disputed Referral, but will act reasonably in making that determination.

4.6 Your responsibility for removing inactive Users

You must promptly remove the Connection of any User that has cancelled their subscription to Your App, or is no longer a paying customer of Your App, to our reasonable satisfaction. This includes any trial User of Your App that hasn’t converted to be a paying customer. Until you do so, that User will continue to be counted as a Referral as set out in section 4.4 above.

See here for details about how to remove a Connection.

4.7 Adjustments to the Monthly Rate

a) At any time after 3 months from the date Your App is made available in the Xero App Store:

i) if the actual Average Revenue Per User over any rolling 3 month period exceeds the Monthly Rate by 5% or more, you must promptly notify us of this; or

ii) either of us can send a notice to the other party to request that the Monthly Rate is reviewed (but no more than once every 3 months), (each a “Review Request”).

b) Within 15 days of either of us receiving a Review Request from the other party, you agree that you’ll provide a written report to us setting out (as at the date of the Review Request):

i) details of each of the different pricing plans for Your App that are available to, and/or subscribed to by, any Referral;

ii) the total number of Referrals subscribed under each of those different pricing plans; and

iii) the total combined revenue that you have received from all Referrals, for each calendar month since the date Your App was made available in the Xero App Store.

c) Once we’ve received your report, we will (in consultation with you) calculate and notify you of any adjustment required to the Monthly Rate. If you fail to provide us with your report, we will calculate any such adjustment based upon our reasonable judgement and the information available to us.

d) In making any adjustment to the Monthly Rate, we will do so with the aim of ensuring that the Monthly Rate is equal to 15% of the Average Revenue Per User.

e) Any adjustment to the Monthly Rate will apply from the date we notify you of such adjustment, unless you have failed to issue a notice to us when required under section 4.7(a)(i) in which case the adjustment may apply retrospectively from when the actual Average Revenue Per User over any rolling 3 month period started exceeding the Monthly Rate by 5% and we may include on our next invoice any additional Xero App Store Fee payable by you as a result.

5. Complying with law

a) You agree to comply with any laws that apply to you or the matters you are responsible for under these Terms.

b) We agree to comply with any laws that apply to us and the matters we are responsible for under these Terms.

6. Your important responsibilities

6.1 Your ongoing obligations

In order to remain an App Partner and be entitled to have Your App listed on the Xero App Store, you need to:

a) continue to comply with the requirements available here (including the Developer Platform Terms and Conditions);

b) adhere to Xero’s security requirements that we notify to you;

c) adhere to the brand and marketing guidelines that we will notify to you once you have been certified to join the Xero App Store;

d) actively support and maintain the integration of Your App with Xero’s services and meet any updated integration requirements over time;

e) otherwise act in good faith in using Xero’s services and maintaining your integration; and

f) maintain and grow customers on Your App that are also actively using Xero’s services.

6.2 You are responsible for Your App

We provide the Xero App Store, but we have no control over Your App. You are responsible for any and all losses, liabilities, damages, costs or expenses, claims or proceedings involving or relating to Your App.

6.3 We are relying on the information that you provide us

a) You are responsible for making sure that any information you provide and your activity relating to the following is accurate, complete and complies with all applicable laws:

i) the listing of Your App on the Xero App Store; and

ii) your Stripe Custom Connect account, including all Stripe Custom Connect Data and any information required by Xero to calculate the Applicable Taxes (if you are on Xero App Store Subscriptions).

b) You agree that:

i) we are entitled to and will rely on any information you provide to us (even if you provide that information to us indirectly, including via your Stripe Custom Connect account); and

ii) if any of that information is wrong, false or misleading we won’t be liable for anything that results from us relying on that information.

6.4 Maintaining the listing of Your App on the Xero App Store

You will need to actively manage the listing of Your App on the Xero App Store. This includes making sure that any information that is relevant to the purchase of Your App by Users is prominently displayed on the Xero App Store, including for example information about:

a) Your App and its functionality;

b) your prices, exclusive of any Applicable Taxes and billing;

c) the length of the subscription, including details about renewals; and

d) your privacy notice and terms of use (including the licence of Your App to the User).

6.5 Maintaining the ‘Sign up with Xero’ feature

You must implement and maintain our single sign up feature, currently known as ‘Sign up with Xero’, for all Users of Your App.

6.6 Providing customer support

a) You will be responsible for providing any and all customer support requested by Users of Your App (including in relation to onboarding and setup, any technical, connection or integration issues, managing disputes, refunds, reversals, and associated fines, and any other issue or incident related to Your App).

b) We may choose to provide customer support to Users of Your App too (but we’re not required to and this doesn’t change your responsibilities above).

7 Privacy

7.1 Personal information collected by Xero

a) When using the Xero App Store, you may provide some personal information to us about yourself (such as your contact information) in order to interact with us and to receive your share of the User Payments.

b) We may reveal personal information about you for attribution purposes, handling inquiries from Users or potential Users, and other purposes which are necessary for us to perform our obligations under these Terms. We may access, preserve, and disclose your personal information (including your account details) if required to do so by law, or if such access, preservation, or disclosure is necessary to comply with a legal obligation or is in the legitimate interests of us or a third party (for example, to protect the rights, property, or safety of Xero, its affiliates or partners, its Users, or the general public).

c) Please click here to view our Privacy Notice, which contains further information about the way in which we handle personal information.

7.2 Your compliance with privacy laws

You must comply with all laws, regulations, regulatory requirements and codes of practice related to the protection of personal data applicable to you or us in connection with your use of the Xero App Store, including:

a) where Your App is included in the Australian Xero App Store, the Australian Privacy Act 1988 (Cth), including each of the APPs, as if you were an ‘organisation’ subject to that legislation, in relation to all personal information of Users that we provide to you;

b) where Your App is included in the New Zealand Xero App Store, the New Zealand Privacy Act 2020 as if you were an ‘agency’ subject to that legislation, in relation to all personal information of Users that we provide to you; and

c) where Your App is included in the United Kingdom Xero App Store, the United Kingdom Data Protection Act 2018, the UK version of the General Data Protection Regulation (“UK GDPR”) and the Privacy and Electronic Communications (EC Directive) Regulations 2003, in relation to all personal information of Users that we provide to you, you provide to us, or you otherwise collect from Users in connection with Your App.

7.3 Independent controller responsibilities in respect of User Payment Data

a) As part of using the Xero App Store, you may be transferred a copy of and use the personal information of Users (for example, User sign-on information, like name and email address, and User subscription information, like product ID, price, organisation/subscription ID, and subscription start/end date) in connection with the User Payment process (“User Payment Data”). However, you and we will each be making our own decisions about how and why the User Payment Data is used at the different stages in the User Payment process. As a result, you and we will each be “Independent Controllers” in respect of the User Payment Data for the purposes of UK GDPR.

b) Being Independent Controllers in respect of the User Payment Data means you and we will each have certain data protection responsibilities in respect of the User Payment Data. Those responsibilities are as follows:

i) when we transfer User Payment Data to you, we will make sure that the User Payment Data being transferred is accurate and up-to-date;

ii) we will only transfer User Payment Data to you where a purpose has been identified for that transfer. The transfer will only be made exclusively for, and only where necessary to achieve, that purpose and not for any other purpose;

iii) when we transfer User Payment Data to you, you will make sure it is only accessible by those of your employees, sub-contractors or other workers (“Developer Personnel”) who need access to it to perform their obligations under these Terms. Any Developer Personnel must be informed of the fact the User Payment Data is confidential and of the security procedures relating to it, and must be contractually bound to keep it confidential;

iv) you will put in place and maintain suitable technical measures and other measures within your organisation relating to your use of the User Payment Data to ensure it remains secure after we have transferred it to you. These measures will be proportionate to the level of risk associated with that User Payment Data (for example, any financial information will require particularly strong technical security measures);

v) when we transfer User Payment Data to you, you will not keep it for longer than is reasonably required in relation to the purpose for which you are using it;

vi) when we transfer User Payment Data to you, if you become aware of the accidental, unlawful or unauthorised destruction, loss, alteration, disclosure of, or access to that User Payment Data or anything else unauthorised or unlawful that happens to that User Payment Data (a “Data Breach”), you will notify us within 48 hours of the time you became aware of the Data Breach, and provide us with details of the Data Breach along with that notification;

vii) if either of us receives a communication from a regulator which relates directly or indirectly to the other party’s use of the User Payment Data, the party who has received this will notify the other party promptly and provide details, and will provide reasonable co-operation and assistance in responding to the regulator; and

viii) you will allow for and contribute to audits and inspections carried out by us (or by another party instructed by us) in respect of your use of any User Payment Data which we have transferred to you. Any such audit or inspection will be carried out no more than once each calendar year and on no less than four weeks’ written notice from us to you.

8. Confidential information

While using our services, you may share confidential information with us, and you may become aware of confidential information about us. You and we both agree to take reasonable steps to protect the other party’s confidential information from being accessed by unauthorised individuals. You or we may share each other’s confidential information with legal or regulatory authorities if required to do so.

9. Intellectual property rights

a) Each of us will continue to own Material that each of us possess before entering into these Terms, or create during the term of these Terms. “Material” includes content, images, data and information in any form.

b) Until such time as these Terms are cancelled:

i) we grant you a licence to use any Material we provide to you for the purpose of these Terms; and

ii) you grant us a licence to use any Material you provide to us, and your trademarks and logos, for the purpose of these Terms. This includes the right to display on the Xero App Store any such Material that you have provided to us for that purpose.

c) Each of us agree to ensure that any Materials we licence to the other do not infringe any rights of any third parties.

10. Important limits on liability

a) We will not be liable for any indirect or consequential loss or for any loss of profits, opportunity, revenue, goodwill, anticipated savings, loss of use of any machine or computer, or loss or corruption of data, even if that loss could have been foreseen or we were advised of the possibility of the loss.

b) Other than liability that we can’t exclude or limit by law, our total aggregate liability to you under or relating to these Terms in each calendar year is limited to the total Xero App Store Fees we have received under these Terms in that calendar year.

c) Section 10(b) doesn’t apply to a breach of section 8 by us, or to our obligation to remit payments to you under section 3.3(f).

d) The limits of liability in this section 10 apply to all liability, regardless of whether it arises in contract, tort (including negligence), under statute or on any other basis.

e) Any terms or representations that relate to these Terms or the Xero App Store, but are not stated in these Terms, are excluded to the extent that they can be under the law.

f) Each of our liability to the other party is reduced to the extent that the other party’s actions or inactions, or those of a third party, contributed to or caused the liability.

g) In some places, there may be non-excludable warranties, guarantees or other rights provided by law (non-excludable guarantees). They still apply – these Terms do not exclude, restrict or modify them. Except for non-excludable guarantees and other rights you have that we cannot exclude, we’re bound only by the express promises made in these Terms. Our liability for breach of a non-excludable guarantee is limited, at our option, to either resupplying or paying the cost of resupplying the relevant service (unless the non-excludable guarantee says otherwise).

11. Our rights to suspend or limit your use of the Xero App Store

We may suspend or limit your use of the Xero App Store if:

a) you or Your App cease to meet the requirements referred to in section 2.1;

b) you fail to materially comply with any of your responsibilities under section 6 of these Terms; or

c) we decide that we need to in order to:

i) prevent or stop a breach of law;

ii) prevent or stop fraud or other wrongful conduct; or

iii) in connection with your breach of these Terms:

A) prevent us incurring liability to any other person;

B) prevent harm being suffered by another person;

C) protect the security and integrity of the Xero platform or ecosystem; or

D) prevent any other materially detrimental consequences.

We may take these actions immediately, but we will endeavour to notify you promptly if we do so.

12. Changes to these Terms

a) We may need to update these Terms, including any linked materials, as our ecosystem evolves. If we do, we will give you notice at least 30 days in advance except where such changes are required more urgently to comply with any law, reflect any changes required by our suppliers (including Stripe), or to protect the Xero platform or ecosystem. If you do not accept any such changes, you may cancel these Terms by giving us notice at any time before the changes come into effect.

b) Any other changes to these Terms need to be made in writing and signed by each of us.

13. Cancelling these Terms

a) Either of us can choose to cancel these Terms at any time by giving the other party 30 days’ notice in advance.

b) If either of us becomes insolvent or makes any arrangement with creditors, goes into liquidation, has a receiver or manager appointed over any assets, or becomes subject to any insolvency event in any jurisdiction, the other party can cancel these Terms immediately by giving notice.

14. Notifying each other

a) If you need to give a notice about something under these Terms, please send us an email to legalnotices@xero.com.

b) If we need to give you notice about something under these Terms, we will send an email to the email address that you register with us. You can update your email address by logging into your account on the Xero website.

c) If either of us sends a notice by email under these Terms, unless that party receives an automated message that the email wasn’t delivered, we both agree that the email will be ‘delivered’ 30 minutes after the time it was sent.

15. Disputes

Most of your concerns can be resolved quickly and to everyone’s satisfaction by contacting our support team using the contact details on our website. If we’re unable to resolve your complaint to your satisfaction (or if we haven’t been able to resolve a dispute we have with you after attempting to do so informally), you and we agree to resolve those disputes through binding arbitration or small claims court instead of in courts of general jurisdiction. You and we agree that any dispute must be brought in the parties’ individual capacity and not as a plaintiff or class member in any purported class or representative proceeding.

16. Other general terms

a) We do our best to control the controllables. We aren’t liable to you for any failure or delay in performance of any of our obligations under these Terms arising out of any event or circumstance beyond our reasonable control.

b) Subject to section 3.3(c), nothing in these terms is to be construed as constituting a partnership, joint venture, employment or agency relationship between you and us.

c) We may assign these Terms - or any of our rights or obligations in these Terms - to another Xero entity as we deem appropriate. Xero entities are the companies controlled by or under common control with Xero Limited (a New Zealand company with registration number 1830488).

d) If there’s any part of these Terms that either one of us is unable to enforce, we’ll ignore that part but everything else will remain enforceable.

e) Words like ‘include’ and ‘including’ are not words of limitation and where anything is within our discretion we mean our sole discretion.

f) These Terms form the entire agreement between us and you in relation to their subject matter. They replace everything else that has been communicated between us and you in any form in relation to their subject matter. However nothing in these Terms limits any liability either of us may have in connection with any representations or other communications (either oral or written) made before or after entering into these Terms, where such liability cannot be excluded by law.

g) If there is any conflict between these Terms and the other documents linked or referred to in these Terms, these Terms will take priority.

h) Sections 3.10(c), 7, 8, 9(a), 10, 14, 15, 16 and 17 of these Terms (as well as any other section that by its nature is intended to continue to apply) will still apply after these Terms come to an end. In addition, each of us will continue to comply with these Terms in relation to any transactions initiated before these Terms come to an end.

i) Each of us will use reasonable efforts to do anything that’s necessary to give full effect to these Terms.

j) If either of us has a right under these Terms and doesn’t exercise it (or only partly exercises it), that party can still exercise that right, or another right, later on.

k) If one of us chooses to waive a right that it has under these Terms, that waiver will only apply if it is in writing and signed by that party.

17. Which Xero company you are contracting with and the law that applies to these Terms

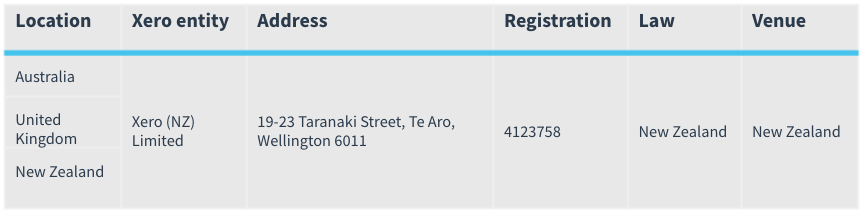

Our contracting entities are listed in the table below along with what law and venue apply in any dispute between you and us, based on the location of your principal place of business:

Xero App Store Subscriptions

Commercial Billing

Appendix

1. Delivery of Your App to Users resident in New Zealand

This section applies to supplies of Your App made by you via the Xero App Store to Users who are resident in New Zealand. You appoint Xero (NZ) Limited (“Xero NZ”) as your agent for the delivery of Your App via the Xero App Store to Users resident in New Zealand.

You and Xero NZ agree that:

a) pursuant to section 60C of the Goods and Services Tax Act 1985 (“NZ GST Act”), Xero NZ is the operator of the electronic marketplace in respect of supplies made by you, through Xero NZ as agent, to Users who are resident in New Zealand;

b) in accordance with the NZ GST Act, the supplies made by you, through Xero NZ as agent, to Users who are resident in New Zealand, are treated as two separate supplies for GST purposes, being:

i) a supply of services from Xero NZ to Users who are resident in New Zealand; and

ii) a supply of services from you to Xero NZ;

c) Xero NZ will issue required tax invoice and credit note documentation for the supply of services made from Xero NZ to Users who are resident in New Zealand, and you will not issue any tax invoice documentation to Users who are resident in New Zealand, in respect of those services;

d) Xero NZ will issue required tax invoice (which will function as a Buyer-Created Tax Invoice if you are registered for New Zealand GST) and credit note documentation for the services made from you to Xero NZ, and you will not issue any tax invoice documentation to Xero NZ in respect of those services;

e) Xero NZ will, in respect of the Xero App Store Subscriptions Xero App Store Fee, deduct any GST payable, as an additional amount, from the payments made to you;

f) you indemnify and hold Xero NZ harmless against any and all claims by Inland Revenue for any non-payment or under-payment of GST under the NZ GST Act, and for any penalties and/or interest imposed thereon; and

g) Xero NZ will rely on the information you provide regarding your jurisdiction of residency and GST registration status in respect of determining the appropriate GST treatment for your transactions (including the GST treatment of the Xero App Store Fee), and you warrant that the information you provide in this respect is correct and accurate. You further warrant that you will notify Xero NZ should you become or cease to become GST registered in New Zealand.

2. Delivery of Your App to Users resident in Australia

This section applies to supplies of Your App made by you via the Xero App Store to Users who are resident in Australia. You appoint Xero Australia Pty Limited (“Xero AU”) as your agent for the delivery of Your App via the Xero App Store to Users resident in Australia.

Scenario One

This Scenario One will apply if you are:

a) GST registered and resident in Australia; or

b) GST registered in Australia but not a resident of Australia and you are selling to Users that are GST registered in Australia.

You and Xero AU agree that:

a) pursuant to section 153-50 of the A New Tax System (Goods and Services Tax) Act 1999 (Cth) (“AU GST Act”), for the supplies made by you, through Xero AU as agent, to Users who are resident in Australia:

i) Xero AU will be deemed to be making the supplies to Users who are resident in Australia; and

ii) you will be deemed to be making separate, corresponding supplies, to Xero AU;

b) Xero AU will issue the required tax invoice (and if necessary, the adjustment note documentation) for the deemed supplies made by from Xero AU to Users who are resident in Australia, and you will not issue any tax invoice or adjustment note documentation to Users who are resident in Australia, in respect of those deemed supplies; and

c) Xero AU will provide a document to you in respect of the deemed supplies made by from you to Xero AU, and the Xero App Store Fee for Xero App Store Subscriptions charged to you by Xero AU will be net-off against the deemed supplies (i.e. net deemed value = deemed supply made by Xero AU to resident in Australia less deemed supply made by you to Xero AU), and you will not issue any tax invoice documentation to Xero AU in respect of those deemed supplies.

Scenario Two

This Scenario Two will apply if you are:

a) resident in Australia but not GST registered; or

b) not GST registered nor resident in Australia and you are selling to Users that are GST registered in Australia.

You and Xero AU agree that:

a) Xero AU will issue the required tax invoice and adjustment note documentation, on your behalf, for services provided to Users who are resident in Australia, and you will not issue any tax invoice or adjustment note documentation to Users who are resident in Australia, in respect of those services; and

b) Xero AU will issue tax invoices to you in respect of the Xero App Store Fee for Xero App Store Subscriptions and will deduct any GST payable, as an additional amount, from the payments made to you.

Scenario Three (Part One)

This Scenario Three (Part One) will apply if you are not resident in Australia, registered for Australian GST, and you are selling to Users which are (a) not GST registered in Australia or (b) using the software/services for private purposes.

You and Xero AU agree that:

a) pursuant to sections 84-60 of the AU GST Act, Xero AU is the Electronic Distribution Platform (EDP) operator and as such, is treated for AU GST purposes as the ‘supplier’ in respect of supplies made by you to Users who are ‘Australian consumers’ (as defined in the AU GST Act) in Australia through Xero AU’s platform;

b) Xero AU will issue the required tax invoice and adjustment note documentation, on your behalf as the EDP operator, for services provided to Users who are resident in Australia, and you will not issue any tax invoice or adjustment note documentation to Users who are ‘Australian consumers’ (as defined in the AU GST Act) in Australia, in respect of those services; and

c) Xero AU will issue tax invoices to you in respect of the Xero App Store Subscriptions Xero App Store Fee and will deduct any GST payable, as an additional amount, from the payments made to you.

Scenario Three (Part Two)

This Scenario Three (Part Two) will apply if you are not resident in Australia, not registered for Australian GST and you are selling to Users which are (a) not GST registered in Australia or (b) using the software/services for private purposes.

You and Xero AU agree that:

a) pursuant to sections 84-70 of the AU GST Act, Xero AU is the Electronic Distribution Platform (EDP) operator and as such, is treated for AU GST purposes as the ‘supplier’ in respect of supplies made by you to Users who are ‘Australian consumers’ (as defined in the AU GST Act) in Australia through Xero AU’s platform;

b) Xero AU will issue the required tax invoice and adjustment note documentation, on your behalf as the EDP operator, for services provided to Users who are resident in Australia, and you will not issue any tax invoice or adjustment note documentation to Users who are ‘Australian consumers’ (as defined in the AU GST Act) in Australia, in respect of those services;

c) Xero AU will issue tax invoices to you in respect of the Xero App Store Subscriptions Xero App Store Fee and will deduct any GST payable, as an additional amount, from the payments made to you;

d) Xero AU will rely on the information you provide regarding your jurisdiction of residency and GST registration status in respect of determining the appropriate GST treatment of supplies made to Australian-resident Users and Xero AU’s supplies to you, and you warrant that the information you provide in this respect is correct and accurate. You further warrant that you will notify Xero AU if You become or cease to become GST registered in Australia.

In all scenarios set out under this section 2 of the Appendix, you indemnify and hold Xero AU harmless against any and all claims by the Commissioner of Taxation for any non-payment or under-payment of GST under the AU GST Act, and for any penalties and/or interest imposed thereon.

3. Delivery of Your App to Users resident in the United Kingdom

This section applies to supplies of Your App made by you via the Xero App Store to Users who are resident in the United Kingdom. You appoint Xero (UK) Limited (“Xero UK”) as your agent for the delivery of Your App via the Xero App Store to Users resident in the United Kingdom.

You and Xero UK agree that Xero UK operates a digital platform that you are using to make supplies to Users who are resident in the United Kingdom. In accordance with the terms and conditions of this agreement:

a) Xero UK (as the operator of the digital platform) will charge and account for UK VAT due on sales of Your App to Users resident in the United Kingdom in accordance with s.47(4) of the Value Added Tax Act 1994 (“VATA 1994”). Where required to, Xero UK (and not you) will issue a UK VAT invoice for these sales; and

b) if you are both VAT registered and established in the United Kingdom for UK VAT purposes, you will be required to account for UK VAT on the services you are deemed to supply to Xero UK in accordance with s.47(4) of the VATA 1994.

Self-Billing Agreement

You and Xero UK agree to enter into the terms of this self-billing agreement as set out below (“Self-Billing Agreement”), under which Xero UK will issue self-billed invoices for the services that you are deemed to supply to Xero UK for UK VAT purposes, in accordance with s.47(4) of the VATA 1994.

You and Xero UK agree that:

a) the start date of this Self-Billing Agreement will be the same as the start date of these Terms, and the end date will be the date these Terms are cancelled;

b) you will accept self-billed invoices raised by Xero UK pursuant to this Self-Billing Agreement until the end date of this Self-Billing Agreement, and you will not issue any VAT invoices to Xero UK in respect of the supplies that this Self-Billing Agreement applies to;

c) if you are UK VAT registered and supplying Your App from a UK establishment, self-billed invoices issued by Xero UK will meet the requirements of a UK VAT invoice, and will be issued showing your name, your address and your UK VAT registration number. If you are not UK VAT registered and established for UK VAT purposes in the United Kingdom, self-billed invoices issued by Xero UK will not constitute a UK VAT invoice;

d) you will notify Xero UK immediately in the event that your UK VAT registration status changes, including if you change your UK VAT registration number, become or cease to be VAT registered, or sell your business or part of your business. You agree to enter into a new self-billing agreement with Xero UK in the event your VAT registration status changes;

e) you indemnify and hold Xero UK harmless against any and all claims by HM Revenue & Customs for any non-payment or under-payment of UK VAT under the VATA 1994 in relation to supplies covered by this Self-Billing Agreement, and for any penalties and/or interest imposed thereon;

f) Xero UK will rely on the information you provide regarding the country you are established in and your UK VAT registration status in respect of determining the appropriate VAT treatment for your transactions, and you warrant that the information you provide in this respect is correct and accurate; and

g) in accordance with s.47(4) of the VATA 1994, the Xero App Store Fee payable by you to Xero UK will not represent payment for a separate supply of agency services for UK VAT purposes.